What Is Happening

Recently, Australia stated there ought to be an investigation into the Chinese Wuhan Covid Virus, where it originated, how it spread, what could have been done better. This is pretty much standard procedure for any Bad Thing that happens. China, being pissy petty dictators unaccustomed to open inquiry into their mistakes, decided that acting like a bully and spitting in the eye of their customers / suppliers was the way to go. (“Intelligence is limited, but stupidity knows no bounds. -E.M.Smith”)

So China shut off beef imports from 4 Australian meat packers and slapped something like an 80% tariff on Australian Barley along with making “Nice family you got there, be a shame if something happened to it…” noises about the Iron Ore trade and Australian wines, along with the roughly 1/4 of Australian University students who are from China (sons and daughters of The Communist Party) and all their loverly tuition money. This is commonly called Blackmail and is considered a criminal act in some circles. In all circles it is NOT something one party does to another when they respect that party, or when they value them.

So what’s a fella to do, eh?

Well, first off, the LAST thing you EVER do with a bully is give in. You may take a thumping but the bully will remember the hits he took. As my Sensei said: “When too tigers fight, one of them dies and the other is seriously wounded”. Do not be a sheep, be the 2nd Tiger. So first thing to settle on is to “give as good as you take”. Put a “compensatory tariff” on Chinese imports. Make it clear that will be removed when China starts behaving like a partner instead of a bully.

Second, realize that China is NOT playing a competitive capitalist level playing field game. They are playing entirely to strip you of assets. They are not “investing” in Australia. Stop calling it that. They are buying control of Australian Assets. As EVERY Chinese international company is a State Sponsored Enterprise, they can draw on the full financial clout of the Chinese Central Bank. That means their cost of borrowing can be zero or even negative. YOUR companies can not do that. This means that a Chinese Company can get free money to stay in business until YOUR companies are driven out of business. Then they can buy any and all assets, vertically integrate (silo) and ship all the goods, factories, profits, and jobs back to China. So right out the gate, do not let them list on your stock exchange unless they follow YOUR rules for transparency, book keeping, etc. Second, do NOT let them buy a vertical integrated chunk of your economy to control. Put those rules on the books now.

Frankly, were it up to me, I’d never let any State Sponsored Enterprise buy ANY business / assets in my country. You are simply handing CONTROL of that sector to a foreign government. Economies of scale extend to financing and result in a “Fattest Wallet Wins” effect. The company with the most money gets the cheapest loan rates and can just crush any competitors. State owned enterprises have an infinite sized wallet as they can draw on the national ability to print money and issue zero interest loans.

Fungible Commodities

OK, with that basic context, back on commodities.

The key word here is “Fungible”. That means any one is pretty much the same as any other. You can substitute Red Winter Wheat from Canada with that from Russia or the USA and not really notice a difference. One dollar bill spends the same as any other. This is pretty much the rule in commodities. That’s why it is so competitive a market. (Compare with a patented drug or a proprietary computer chip – it is one of a kind and available from one source only.)

So what’s the nature of beef and barley? They are fungible commodities. If I buy malting barley to make beer, I don’t really see much difference between that from Australia and that from Canada.

Now the 2nd key concept is “market equilibrium”. Right now the amount of barley sold is pretty much in equilibrium with that demanded, globally. No real glut nor shortage. If China shifts a Million Tons of barley purchases to Canada, then someone who was buying Canadian barley is not going to get his Million Tons and will be looking for who has some. Enter Australia. So your next strategic thing to do is just look at where China buys barley, and find out who’s short. Then market to them. Your shipping changes, but not much else.

Similarly beef, except right now Beef is in short supply. Chinese Wuhan Covid Virus has caused beef supply disruptions in Europe and the USA among other places. You ought to have no problem finding customers. But beef does not store as well as barley. You can store barley for years in silos if desired, but beef takes expensive freezers (and even then can’t be stored for years without quality suffering).

With Brexit in progress, the UK is still under EU rules. So it is unlikely that the UK can take a lot more unless you already meet E.U. standards and have a competitive price. But if that is the case, ring up the UK and ask if they want it as steaks or Sunday Roasts.

So what else to do? First up, the Australian Government ought to announce a price support / commodity storage program. Essentially state that they will buy the barley at the regular price if no other buyer can be found, and then store it in silos until demand picks up again. Take the heat off the farmers in the short run until new markets can be found. Don’t have silos? Build them! Call it a jobs program…

For beef, maybe every Australian just needs to load up their freezer and have a bit more Steak for a while ;-) In addition to that, it might make sense to establish a beef jerky operation to turn some of it into a higher priced and longer storage form. I know I’d buy a few bags of Outback Jerky…

Of Wine & Fodder

As per Australian Wines, well, the whole world loves a drop, so just keep shipping them! Beer too!

There’s also one other interesting point. Australia last year was a bit short on feed grains for cattle. Well, if you have extra barley, you can put it in cattle feed. Note that grain for cattle feed can have any of several grains in it in various amounts, depending on what is in excess. That fungible thing again. So ship some of your barley over to your cattle feed lots. There’s also an interesting new tech that sprouts the barley into fodder mats that are fed to cattle / dairy herds. As Australia can be a bit thin on rain and pasture, this would be a great way to turn your barley into cattle fodder. You folks are already doing this, so just do more of it!

What has revolutionized sprouted barley fodder as a viable feed alternative is high efficiency fluorescent and LED lighting and more affordable climate control systems. LED lighting in particular is very energy efficient with little excess heat generated. Although LED is more expensive to buy upfront, the long-term operating expenses are greatly reduced. LEDs also last much longer than any other option, and do not lose output over time.

Many of the advances made in sprouted barley fodder have come from Australia–several of the systems used here are based on their designs. During Australia’s severe droughts, barely fodder provides valuable nutrition when fresh pasture is not available. Here in the U.S., the sprouted barley fodder is often brought into the ration to replace protein previously supplied by dry grain. Of course, it is also beneficial in the non-pasture season to bring fresh forage to the animals.

As the “feed conversion ratio” for cattle is about 10:1, every pound of steak takes 10 pounds of barley. You can very rapidly soak up a LOT of barley feeding cattle. So another easy thing to do is for the Government to offer interest free loans to cattle operations to buy and operate a barley fodder station for their cattle. Why ship cheap grain to China when you can turn it into very nice very expensive steaks and nice high priced cheeses?

By setting up more of those fodder stations, you make barley fungible with other fodder sources.

How Much Global Barley Trade Is There?

Or put another way: With whom is your barley fungible in terms of suppliers? How much?

http://www.worldstopexports.com/barley-exports-by-country/

Unfortunately this is in dollars, not tons, but as the price ought to be about the same (modulo shipping costs / discounts) it’s good enough. Note that Australia is in the #3 spot. Argentina is almost the same size, but after that top 4, the rest just don’t have the volume to cover Australia. So start checking on sales from France, Russia, and Argentina. Find out who’s being left short of supply by Chinese buying, and make them an offer.

Below are the 15 countries that exported the highest dollar value worth of barley during 2019.

France: US$1.5 billion (22.5% of total barley exports)

Russia: $762 million (11.3%)

Australia: $726.7 million (10.8%)

Argentina: $719.8 million (10.7%)

Canada: $532.1 million (7.9%)

Ukraine: $445.1 million (6.6%)

United Kingdom: $370.4 million (5.5%)

Germany: $309.5 million (4.6%)

Kazakhstan: $299.5 million (4.5%)

Romania: $211.2 million (3.1%)

Denmark: $118.2 million (1.8%)

Estonia: $80.9 million (1.2%)

Hungary: $79.3 million (1.2%)

Lithuania: $55.3 million (0.8%)

Czech Republic: $50.4 million (0.7%)

Pay particular attention to France who have been growing volume lately. OTOH, shipping costs from France can’t be all that cheap. Canada would be an easier replacement source (assuming China is shipping in their national carrier ships and not via rail so needs to divert the ships). But Canada will be hard pressed to deliver the volume. Lets face it: Australia is a VERY large player in this market at about 11% and that’s not going to be easy to pick up from the other growers. Especially as weather has been “not so good” for growing grains lately in several areas.

https://www.feednavigator.com/Article/2020/05/11/Australia-Plan-B-needed-to-secure-feed-grains

Australia: Plan B needed to secure feed grains, looming Chinese tariff threat on country’s barley exports

11-May-2020 By Jane Byrne

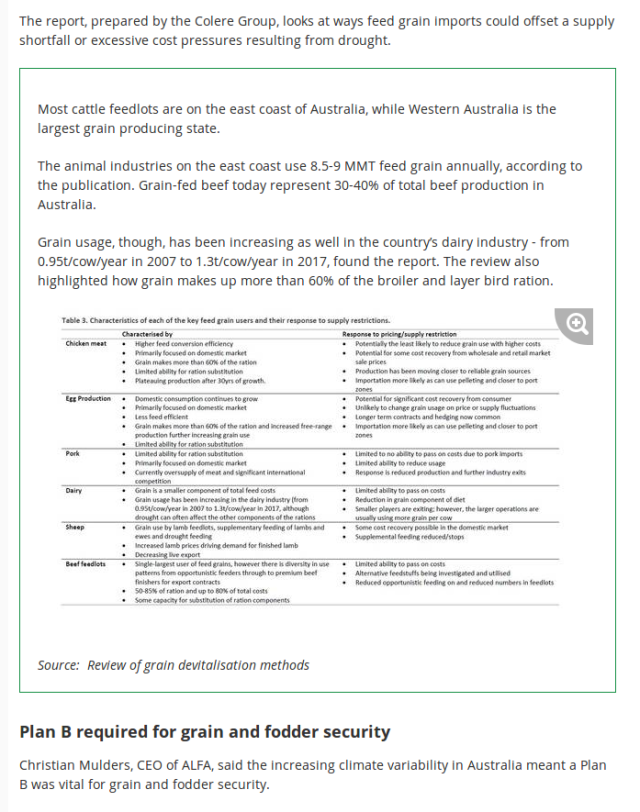

Australia’s livestock production representatives are exploring options to facilitate the safe import of feed grains, given that ongoing drought conditions are putting a squeeze on grain supplies for the country’s feedlots.

So given the need to IMPORT feed grains for cattle, why not just ship your barley surplus (if any remains…) from one coast to the other?

Barley comes in a couple of forms. Barley for eating and barley for malting. Basically cattle don’t care about the particulars of the barley quite as much as do makers of beer and spirits. So to the extent that Barley is of the malting kind and you don’t want to sell it out cheap for cattle feed, I’d suggest setting up a malting operation in Australia and make it into malt. The only reason to send it to China to malt it is to get costs down a modest amount from cheap labor. Making malt is pretty simple. Spread the grain out in a flat floor area of a barn and keep it wet for a few days. Turn it from time to time. When ready, roast it and grind it. It is mostly machinery and very few workers, so the labor costs can’t be that big a part of it. Get yourself set up to make and sell malt and tell China they can buy that if they want.

I find it interesting that this Chinese paper is pushing the FUD (Fear Uncertainty & Doubt) aspect and how much this is a Big Risk for Australia, when in fact in fungible commodities all that happens is folks change partners and shipping plans. But it does have an interesting insight into the Silo For Cheap operations of China.

An Australian native working for a brewery in Shanghai has found himself in the middle of the developing trade dispute between China and Australia, although he is not yet hitting the panic button about the potential Chinese tariffs on barley imports.

[…]

“It could impact us quite badly as we buy Australian barley and malt, and process them in China where it is cheaper,” the brewer, who did not want to be named due to trade sensitivities, said.

So is an Australian Beer company using China as a cheap place to malt their barley? Just tell them to pack up the operation and come back home!

The bottom line on Barley is that when China shifts to another supplier it does not decrease global demand. Furthermore, there’s several destination products for Barley. Animal feed, beer, dinner plates, breakfast cereals, and even whisky.

https://en.wikipedia.org/wiki/Australian_whisky

Australian whisky is whisky produced in Australia. As of February 2020, there are 288 registered distilleries in Australia. In 2019, Australia had 210 distilleries listed, showing significant year-on-year growth.

The Australian Distillers Association is the peak representative body.

The Australian distilling industry is one of the fastest growing and most diverse in the world. A multitude of styles are being made today in all corners of Australia, including single malt, rye and blended whisky.Distillery breakdown per state.

Victoria and New South Wales both have 69 distilleries. Tasmania have 53, Queensland has 32, South Australia has 31, Western Australia has 30 and Australian Capital Territory has four active distillers.

As at the end of 2017, there were more than 120 listed distilleries in Australia with 31 of these in Tasmania.Australia’s largest concentration of whisky distilleries is found on the island state of Tasmania. These distilleries are better known in other parts of the world than in their own country. All of them are very small producers – in comparison to other parts of the world.

The majority of Australian whisky producers make spirit in the Single malt whisky style.

So you have a growing high value industry in making whisky. Do more of it!

https://manofmany.com/featured/12-best-australian-whiskies-you-need-try

You make it, I’ll drink it!

In Conclusion

NEVER EVER give in to a bully tactic. Announce boldly that you are ready and able to just ignore them and walk away, and if punched, punch back harder. Have the government announce low / zero interest loans for expansion of barley fodder operations, domestic malting floors, and both beer and whisky production for export. Pointedly say that China will be welcome to buy the beer and whisky instead of the barley…

Set up roller mills to turn the barley into flakes (it is easier on the teeth that way) and into animal feeds along with breakfast cereals. I’ve a fondness for rolled barley instead of oat meal for breakfast. It’s a very tasty alternative and has more of an energy lift to it IMHO. Less blood sugar impact too as the fiber runs all through the barley not just in the coat. More people ought to discover barley as a breakfast cereal, so start those PSA adverts running.

Take back the value added products chain and stop just being a seller of the very lowest value commodity at the bottom of the supply chain.

And for the love of Mike, do not let China buy control of vertically integrated silos of your country using State Sponsored Enterprises with the Communist Party Infinite National Bank Wallet. They just want to engage in asset stripping and putting you out of work and off your land. They are NOT doing free market anything, it is predatory merchantilism from end to end.

You are preaching to the choir so far as I’m concerned mate, including the naming of the virus. I have committed to attributing it as you do, but you miss out on the expletives.

My take on it all is that it was an accidental release which the CCP quickly weaponised to fit in with their existing World Domination plans (belt & road etc). Their idea is to spread it wide, kill the economies of competitors and move in to snap up bargains including companies, land, ideas, intellectual property etc. etc. After all, through their economic manipulation they own all the money so they can afford it.

I remember what the Arabs did to the oil companies in the 60s. Nationalised them. Took all their investments and just said “No more exploitation that’s all ours now”. We (Aus) should do the same. Maybe we should be a little stealthy, after all, over a billion people Vs 26 million, but I think the Aussies would be happy to give them a big F. U.

A major issue with that idea is that I believe large corporations, the media unis and politicians are deep in hock to the CCP or their proxies; so what used to be the military industrial political complex which now goes far beyond the military; needs to have its back broken.

We are also dependent on many goods, such as pharmaceuticals, so we would be wise to establish alternative sources before we commit too deeply.

My hope is that they were taken by surprise so their plans have been exposed earlier than they would have wished and it is clear to the rest of the World what they’re up to, so we can all combine to push back.

Any thoughts about “nationalizing” Chinese owned businesses?

There is a post at WUWT that I find dangerous given our current experience with China. From the article:

“…

For much of the past two years, Bureau of Economic Geology Director Scott W. Tinker has been traveling the world to film a crucial documentary that illustrates the crisis of energy poverty.

…

“Energy poverty is pervasive,” Tinker said. “Eradicating it will impact the whole world in countless positive ways. It’s not just the right thing to do. It’s the only thing to do.”

…”

I commented that we should help only selected countries. The others didn’t seem to agree. I think we should help only democracies/republics, otherwise countries that sport personal freedoms. One of my comments was that we should pull all our dollars from China, cause a collapse, and maybe then the people there can have a revolution like we did.

Am I wrong about this?

The CCP and its puppet companies own a great number of assets in the US. A government that had a backbone would allow those assets to be attached for damages from the virus, under American Law. The Companies would have the burden of proving independence, difficult if one does not submit to GAP. Our paintiff’s bar is salivating at the thought.

However, since this requires an honest and couragous US government, the CCP has little to fear.

I’d note that we would and should protect assets owned by private Chinese ciitzens, including those sympathetic to their government. Willingness to maintain our standards under duress is why we won rpior wars, and are losing this one.

@Jim2:

You are not wrong. It is stupid to build up political systems that want you gone. Furthermore, countries who’s systems suck the life from the people and economy can not be fixed from outside. Any money & goods supplied will just be redistributed upwards to the power structure that’s sucking out the marrow of free capitalism in the first place.

@Gary:

My first thought is to simply pass laws saying outside companies with State Ownership can not own & control land or facilities and let them sell to locals. If you really want nationalization:

Total up the excess costs of the Chinese Wuhan Covid virus and submit the bill along with the list of assets awarded by the court / government. Furthermore, any industry needed for national security can be taken as a national defense issue. In particular, for an Island Nation, any port facilities are critically important. What happens if a Chinese owned port just decides to shut down for a 6 month deep cleaning and staff vacation time?

@Andysaurus:

The Chinese billion is focused on a land army. They can’t get to you. What matters is their navy and how well you can sink it. I’m pretty sure your Air Force knows how to sink ships. Besides, they’d have to get through the US Pacific Fleet first and that ain’t gonna happen.

@Richard:

I heard a news report of some change being moved forward to require GAP conformance for NYSE stock listing, so folks being less timid now.

E M Nice well researched and well informed post. Good for us Aussies to read it. Even btter if our benighted pollies read it.

I’m wondering if Texas Geologist Scott W. Tinker is trying to gen up more markets for oil. The price has recovered to $30/bbl, but that’s still too low for a bunch of shale companies. Texas is in a world of hurt. As always, the price will recover, but still for now, world of hurt.

Thx E.M. Timely advice that we in Oz need to act on. I’m letter writing guvuhmint and newsmedia apropos the above.

In the post-Brexit world, a “free trade” and “open seas” (and anti-piracy) alliance among the English speaking nations makes great sense. What’s higher that “most favored nation”? A 21st century Commonwealth, maybe?

With good P.R. the prefix “common” in the name would sell it to low information subjects of the left, and the “traditional” historical aspects would sell it to the citizens of the right.

I like the idea of a market alliance of free countries. They should agree to favor each other with no to low tariffs and set forth a list of “preferred providers” of goods, in order of preference. But they should have no legal standing other than to vote to remove a member.

Of course, there are always ways around these sorts of things. Such as a preferred country surreptitiously sources from a lesser preferred country, then sells the goods.

@jim2:

The classic legal way past that is again exploiting “fungible”. If I have an agreement for preferential export but not import (say I’m the only Barley producer), and I use a lot of my goods internally:

I just buy enough of the outside Barley from the non-preferred country to cover my domestic uses, that, then, frees up all that grain for me to export to the “preferred” folks in the group. Now I’m not breaking the rules as none of them had Barley on offer for me to buy… but I’m essentially substituting external Barley at a cheaper rate into my economy. No need to sell on the foreign stuff…

EMS: I agree. That’s why there should be no legal binding rules from such a cooperative. We ourselves might have to buy something from a less-preferred provider that we can’t get anywhere else, or at least enough of it. For example, rare earths. (Yes, I know we could extract them from sea water, but we do still need to let there be some leakage to keep the price of goods down.)

I know that due to the existing mining sources being mostly China, it is a valid example; but it is a common misconception due to the name containing “rare”, that these are hard to find elements. They are not. I explored that here:

Might be amusing for Australia to set up a Monzanite Sand mining and refining operation in competition. I’m sure many consumers of Chinese product would want to diversify some of their supply, given that China had cut off supply to Japan during a trade dispute…

You would not need a big operation to have the appropriate emotional impact on the CCP Leadership.

My old soldier father used to say “it is the man with the gun who controls the asset. It does not matter who ‘owns’ it”

Or Einstein’s Knowledge is limited, stupidity is limitless

(Because this content is primarily an issue of barley as a commodity, I decidedd to place this material in this topic, instead of “Friends Of Australia Friday #FCFriday”.)

“North American 2 Row vs 6 Row Malting Barley”

11/30/-1[sic] [#] by Paul Schwarz and Richard Horsley (Brewing Techniques):

https://www.morebeer.com/articles/Comparison_Two_Six_Row.

Yes, the difference between the row-types (“varieties”? “cultivars”?) does matter. See esp. § ”Implications for Brewing Practice” (betw. 3/4 and 4/5 of content toward the page-bottom). The focus is on North America, so Australia is not even mentioned; maybe some reader can provide some details on what’s done in Oz.

Considering that the ag.-&-veterinary-oriented U.C. Davis campus is the U.-of-California System’s center for brewing & wine-making studies, and an ag.-econ. major might’ve provided crucial student-priority for registration in its courses, E.M. seems well placed to have snagged a college-level course on brewing [×].

I would not be surprised if E.M. were familiar with the Los Altos (Santa Clara Co., Cal.) home-brewing equipment & supplies “showroom” (est. 2007) of the “MoreBeer!” retail business [♑].

——-

Note # : I suspect “-1” signifies 1999 in a 2-digit year-format implying “20__”, in which the unexpected negative numbers retreat into “19__”. Altho’ techies should be shot for promoting or implementing 2-digit year-formats as late in the development of computing as the 21st Century; they don’t have the excuse of having to squeeze data into fields of 80-col. punch-card anymore. Esp. for 21st-C. years before 2032; because year-formats, esp. the order of their 3 parts, vary dramatically around the world, what am I to make, e.g., of “030201” or “121110”? What if it’s an expiration date on a foreign-manufactured drug or other chemical for which expiration really matters to one’s health?

Note × : It’s possible that the U.C. Davis brewing studies program might not have been authorized until 1978, when U.S. federal law legalized home-brewing (unless prohibited by state law, i.e., Alabama and Mississippi, sigh, each until 2013). If so, E.M. might’ve already been graduated & gone. I was looking for a history link for “brewing option”, but cursory search didn’t find one, so I offer this:

https://foodscience.ucdavis.edu/academic-programs/undergraduate/bs-major-requirements/brewing-option.

Note ♑ : “MoreBeer!” is the original unit, now one of several, of the broader “More Flavor!” business. All its units, except Brewing Techniques magazine, were the result of expansion by the founders, not acquisition:

https://www.morebeer.com/about/history.

The U.C.Davis program was focused on wine, but covered other sorts of zymurgy in various majors. I took “Viticulture & Enology ” when there, but the intro course only. Most California wineries have graduates of their program as Vintner and it is not easy. They are training professionals to world class standards. They have a complete winery setup from harvest to crush, ferment and bottle. With 3000 acres of campus & crops, I’m pretty sure some of it is grapes but they can also buy more from local vineyards.

In the entry of the Vit&Eno building was a 4 inch diameter couple of stories tall glass brandy distillation column. A fun thing to watch (and the aroma… ;-) The campus has covered fermentation for decades prior to my attending and the Vit&Eno building was, um, “vintage” in construction when I was there. IIRC, there wasn’t a general Brewing class as now, but it was likely in the program for food science majors

Yes, I’ve made my own beer and bottled it. There’s a local fermentation shop I’ve used, but not the one you mentioned. Mine is only a couple of miles away. I’ve got a 5 gallon glass carboy and fermentation lock in the garage, but gave my Mr. Beer to P.G.

(Hey, P.G., did you make any beer yet?)

I’ve also made peary and apple cider. (My very first effort was a peach wine in a gallon jug at about 14 years old… it was drinkable, but only just… bread yeast and all…) The last cider I made was about a year+ ago and after bottle finish was quite good. Used a champaign yeast IIRC.

I skipped over the 2 vs 6 row issue (but linked to it). Short form is protein vs starch ratio and which ferments best. Both can make beer, but you want more starch. Some brewers use both for particular effects. USA practice is 6 row plus some 2 row while ROW is almost all 2 row for more starch so higher proof per pound.

As for classification, it has issues:

https://en.wikipedia.org/wiki/Barley#Classification

You are generally safe calling them types or cultivars. It is a one gene mutation.

Per 2 digit year fields:

In 1981 I was criticized by my boss for putting a 4 digit year field in code I was writing. Wasting storage. He believed our codes would not be running in 2000. He was right. The company didn’t exist then. So it was a dice roll decision in many companies. Now not so much. The decision was often not the programmer but the management telling them to remove those wasted 2 digits…

Oh, and probaly ought to note:

While 2 row has more starch than 6 row under dryland growing, with irrigation you can raise starch levels. As much western USA barley is irrigated, our 6 row can have high starch too.

So much of the USA using 6 while rest of world likes 2 row can come down to irrigation practices.

Pingback: Friends Of Australia Friday Tipple Report | Musings from the Chiefio